How to Invest in the Current Market

It seems that investors nearly always face uncomfortable circumstances that might cause doubts about adding or continuing to invest in the stock market. Although events that cause volatility and uncertainty are not usually as extreme as war in Europe, our world supplies enough worries to keep many savers on the sidelines.

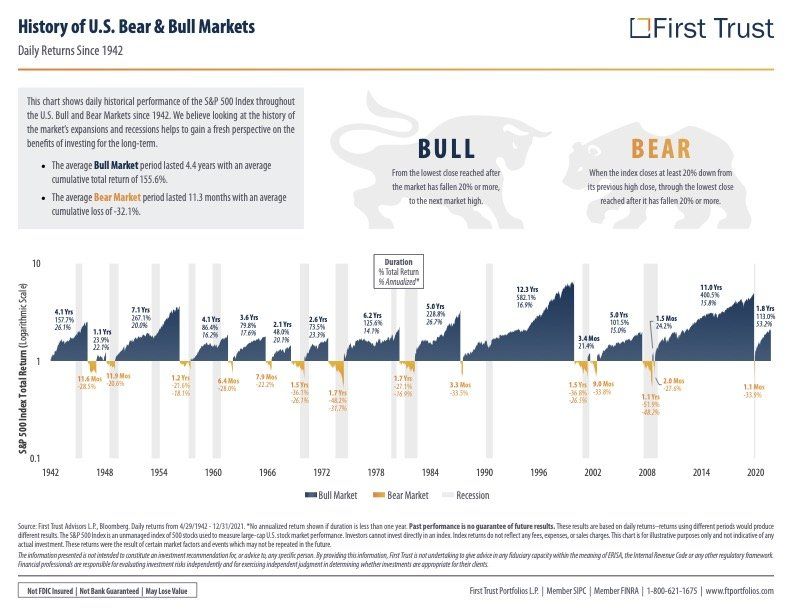

Whenever we’re experienced a correction or significant declines, it’s important to step back and look again at the big picture. The graph above provides a powerful visual image of the historical path of the stock market. Corrections are short and shallow when compared to the strength and length of expansionary periods. Geopolitical events like we are experiencing can certainly have an impact on the global economy, but the key to investment success remains sticking with a strategy for long enough to participate in the growth that has consistently outperformed declines.

It seems quite clear that the market is unpredictable over short periods of time and attempting to pick the next “winner” does not usually end well, achieving growth over long time horizons remains a very likely scenario for patient and courageous investors

Stock prices have declined to levels that we last saw in July of ’21 (if we’re looking at the S&P 500). Now is probably not the time to participate in fear-motivated selling. With the IRA contribution deadline for ’21 coming up next month, it seems more logical to not only receive a tax benefit by adding funds, but also to buy while stocks are at lower prices.

Those with funds currently held in low-interest bearing bank accounts also face decreased purchasing power as inflationary pressures rise – creating another good reason to consider taking advantage of the stock market’s record of consistently outpacing inflation.

As always, don’t hesitate to contact us with questions or concerns. I hope this information is helpful!

LINKS:

HOURS

- Mon - Fri

- -

- Sat - Sun

- Closed

ADDRESS

243 SW Scalehouse Loop, Suite 1A,

Bend, OR 97702

PHONE

A Registered Investment Advisor

Investment Advice is offered through Cascade Financial Strategies, a registered investment advisor licensed in Bend, Oregon, California and Idaho (We also operate in other states under the "de minimis" exemption, meaning having five or fewer clients within that state).

An investment advisor or IA rep may only transact business in a particular state after licensure or satisfying qualifications requirements of that state, or only if they are excluded or exempted from the state’s investment advisor or IA rep requirements; and follow up, individualized responses to consumers in a particular state by investment advisor or IA rep that involve either the effecting or attempting to effect transactions in securities or the rendering of personalized investment advice for compensation, shall not be made without first complying with the state’s investment advisor or IA rep requirements, or pursuant to an applicable state exemption or exclusion. For information concerning the licensure status or disciplinary history of an investment advisor or IA rep, please do not hesitate to contact your state securities law administrator. Cascade Financial Strategies

Sign Up for Our Monthly Article

We will get back to you as soon as possible.

Please try again later.