Four months ago, Engine No. 1, an impact-focused investment firm, released a new ETF that aims to provide an alternative approach to traditional ESG investing. One would assume that an ETF titled NETZ would omit companies from its portfolio that engage in the mining and distribution of fossil fuels, hence the name symbolizing Net-Zero, but the opposite is true. Nearly 23% of NETZ’s portfolio consists of companies in the coal, oil, or gas industry. However, this isn’t something that Engine No. 1 is trying to hide. If you open NETZ’s webpage you can immediately see Shell, Southern Copper, and Occidental Petroleum as some of the ETF’s top holdings.

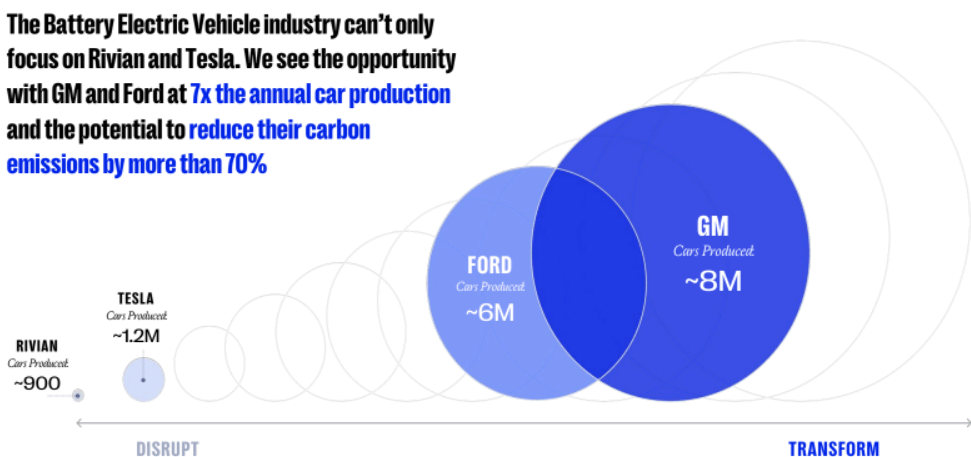

So what’s going on here? The way that Engine No. 1 promotes this is by stating that there is “no path to net-zero that doesn’t go directly through those companies.” They believe that instead of excluding the companies that engage in unsustainable business practices,

they should be investing in the companies that would benefit the most from the transition to renewable energy.

By using strategic voting practices, as well as pushing the potential for these companies to transition over to renewable energy, we see an approach to sustainable investing that hasn’t been taken before, as well as one that may deserve further consideration.

By: Maya Vierra, student intern, and sophomore at New York University

Jack Schniepp is a CERTIFIED FINANCIAL PLANNER™ (CFP®, ChFC®) and the owner of Cascade Financial Strategies. CFS is a registered investment advisor located in Bend, Oregon and licensed in Oregon, California, Washington, Arizona and Idaho. They specialize in socially responsible investing which integrates environmental, social, and corporate governance (ESG) criteria into portfolio construction.

LINKS:

HOURS

- Mon - Fri

- -

- Sat - Sun

- Closed

ADDRESS

243 SW Scalehouse Loop, Suite 1A,

Bend, OR 97702

PHONE

A Registered Investment Advisor

Investment Advice is offered through Cascade Financial Strategies, a registered investment advisor licensed in Bend, Oregon, California and Idaho (We also operate in other states under the "de minimis" exemption, meaning having five or fewer clients within that state).

An investment advisor or IA rep may only transact business in a particular state after licensure or satisfying qualifications requirements of that state, or only if they are excluded or exempted from the state’s investment advisor or IA rep requirements; and follow up, individualized responses to consumers in a particular state by investment advisor or IA rep that involve either the effecting or attempting to effect transactions in securities or the rendering of personalized investment advice for compensation, shall not be made without first complying with the state’s investment advisor or IA rep requirements, or pursuant to an applicable state exemption or exclusion. For information concerning the licensure status or disciplinary history of an investment advisor or IA rep, please do not hesitate to contact your state securities law administrator. Cascade Financial Strategies

Sign Up for Our Monthly Article

We will get back to you as soon as possible.

Please try again later.